Zoho Books cloud-based accounting software

Zoho Books is cloud-based accounting software with integrated customer relationship management (CRM), inventory, and project management system. It offers a wide array of features, including income and expense tracking, invoicing, sales tax management, and time tracking. Zoho Books offers a free plan for businesses that make less than $50,000 in annual revenue and three paid subscriptions that start at $20 per organization, per month.

What We Recommend Zoho Books For

Zoho Books is loaded with many useful features that small businesses can use to automate different business workflows, including bank reconciliation and recurring invoices. Based on our internal case study where we tested the fully functional Zoho Books system, we found that its biggest strengths are inventory management, accounts payable (A/P), accounts receivable (A/R), project accounting, and reporting.

Zoho’s general features are also more developed compared to most similar accounting programs. Based on these results, we recommend Zoho Books for businesses looking for a comprehensive accounting program at a fraction of the cost of more expensive software like QuickBooks.

Zoho Books is especially good for

- Businesses seeking an alternative to QuickBooks: Zoho Books offers many of the same features you’ll find in QuickBooks but at a lower price. As an example, Zoho Books offers project accounting and inventory management in its Professional plan at $24 per month compared to QuickBooks Plus at $85. It made our cut for the best alternatives to QuickBooks for its affordability, particularly for freelancers.

- Freelancers and self-employed businesses: With Zoho Books, you can create and send professional invoices, track time and project expenses to include on invoices, and manage all your clients in one place. If you’re looking for an efficient accounting program for your project-based or hourly freelance business, our guide to the best accounting software for freelancers can help.

- Ecommerce companies looking for integrated management software: Zoho Books integrates with the other Zoho products, like Zoho Inventory and Zoho Commerce, to help automate the different aspects of your ecommerce business, such as sales and marketing, inventory, and accounting. The provider makes our list of the top ecommerce accounting software.

- iOS users: Zoho Books is one of our leading accounting software for Mac users. It enables you to send invoices, estimates, and account statements to clients via iMessage, and Siri can remind you about transactions. What’s more, Zoho Books is available on Apple Watch, making the platform especially helpful to iOS users on the go.

- Businesses that want A/P software with a mobile app: We mentioned that one of Zoho Books’ greatest strengths is its A/P function, and it is even one of our top-recommended A/P software. Its mobile app is great for monitoring expenses and bills and gaining insight into how your business is doing through its key performance indicator (KPI) dashboard.

Zoho Books Accounting Pros & Cons

| PROS | CONS |

|---|---|

| Competitive free plan | Limitation on the number of invoices you can send |

| Loaded with features but more affordable than other similar accounting software | Advanced features, like project accounting and inventory management, are available only in the higher plans |

| All paid plans include access to phone support and live chat | Requires subscription to the Professional plan to manage and track unpaid bills |

| Powerful mobile application that can almost any accounting task | Cannot track fixed assets |

Zoho Books Case Study

In our case study, we thoroughly evaluated Zoho Books to see how it performs across 11 predefined categories and how it stacks up against QuickBooks Online and Xero within the same set of features. The graph below shows the summary of our case study.

Zoho Books vs Competitors FSB Case Study

GeneralBankingAccounts PayableAccounts ReceivableInventoryProject AccountingSales & Other TaxesFixed AssetsReportingCustomer ServiceMobile App0246810

| Quickbooks Online: | Xero: | Zoho Books: | |

|---|---|---|---|

| General | 8.6 | 9.8 | 9.8 |

| Banking | 10 | 9.1 | 9.1 |

| Accounts Payable | 9.8 | 9.65 | 9.7 |

| Accounts Receivable | 9.75 | 8.7 | 9.4 |

| Inventory | 9.75 | 9.75 | 10 |

| Project Accounting | 8.5 | 10 | 9.25 |

| Sales & Other Taxes | 8 | 9 | 7.75 |

| Fixed Assets | 1 | 8.5 | 1 |

| Reporting | 10 | 9.8 | 9.8 |

| Customer Service | 6 | 3 | 10 |

| Mobile App | 6 | 5.25 | 10 |

- QUICKBOOKS ONLINE: STARTING AT $30/MONTH; $85 AS TESTED

- XERO: STARTING AT $11 PER MONTH, $62 AS TESTED

- ZOHO BOOKS: STARTING AT $0 PER MONTH, $60 AS TESTED

Based on the results, Zoho Books emerges victorious in the project accounting, customer service, and mobile app sections. While it trails behind QuickBooks and Xero in the sales and tax category, it is slightly ahead in terms of inventory and has a close fight against QuickBooks in the general features section. Zoho Books’ biggest weakness, just like QuickBooks Online, is fixed asset management. Read our features section for an in-depth analysis of how Zoho Books performed in each category.

Zoho Books Pricing

Zoho Books offers a free plan and three paid subscriptions with prices that start at $20 per organization, per month and go up to $70 per organization, per month. The main differences between the plans include the number of users and invoices and the inclusion of advanced features, such as recurring payments, inventory tracking, budgeting, and custom reporting.

| Free | Standard | Professional | Premium | |

|---|---|---|---|---|

| Pricing($/Organization/Month) | $0 | $20 | $50 | $70 |

| Number of Users Included | 1 user + 1 accountant | 3 | 5 | 10 |

| Cost per Additional User($/Month/User) | $3 | $3 | $3 | $3 |

| Number of Invoices per Annum | 1,000 | 5,000 | Unlimited | Unlimited |

| Import Bank & Credit Card Statements | ✔ | ✔ | ✔ | ✔ |

| Reconcile Bank Accounts | ✔ | ✔ | ✔ | ✔ |

| Chart of Accounts & Subaccounts | ✔ | ✔ | ✔ | ✔ |

| Recurring Invoices | ✔ | ✔ | ✔ | ✔ |

| Recurring Expenses | N/A | ✔ | ✔ | ✔ |

| Track Project Expenses | N/A | ✔ | ✔ | ✔ |

| Lock Transactions | N/A | ✔ | ✔ | ✔ |

| Timesheet & Billing | N/A | ✔ | ✔ | ✔ |

| Manage Bills | N/A | N/A | ✔ | ✔ |

| Track Inventory | N/A | N/A | ✔ | ✔ |

| Track Project Profitability | N/A | N/A | ✔ | ✔ |

| Vendor Portal | N/A | N/A | N/A | ✔ |

| Budgeting | N/A | N/A | N/A | ✔ |

| Generate Custom Reports | N/A | N/A | N/A | ✔ |

| Email, Voice & Chat Support | Email only | ✔ | ✔ | ✔ |

To get a better idea of what to expect from each subscription level, below is a quick overview of each plan.

Free

This is suitable for businesses that earn less than $50,000 in annual revenue. It has a few limitations—for instance, it’s limited to a single user and allows you to send only up to 1,000 invoices per year. It includes the following:

- Bank reconciliation

- Expense tracking

- Mileage tracking

- Chart of accounts

- Online/offline payments

- Journal entries

- Contact management

- 1099 contractor management

- Reports

- Email support

- Client portal

- Sales tax tracking

- Reports

Standard

The Standard plan includes three users and lets you send up to 5,000 invoices per year. It includes everything in the Free plan, plus:

- Recurring expenses

- Live bank feeds

- Predefined user roles

- Project management

- Transaction locking

- Custom views and fields

- Reporting tags

- Bulk updates

- Integrated payment gateways

- Email, voice, and chat support

Professional

This plan has everything in Standard and accommodates businesses that need access for up to five users. It also has:

- Sales orders and purchase orders (POs)

- Sales and purchase approvals

- Vendor credits

- Retainer invoices

- Recurring bills

- Multicurrency support

- Inventory tracking

- Journal templates

- Time tracking and billing

- Job costing

- Up to 10 workflows

- Project profitability

- Custom user permissions

- Email alerts, in-app notifications, and field updates

Premium

Subscribers with up to 10 users should upgrade to Zoho’s highest plan, Premium. It includes everything in the Professional plan, plus the following advanced features:

- Custom domain

- Branches

- Vendor portal

- Custom buttons

- Budgeting

- Related lists and Web Tabs

- Custom functions and schedulers

- Up to 200 workflows

- Custom reports

- Integration with Zoho Sign and Twilio

Add-ons available include:

- Additional user: $3 per user, per month

- Advanced autoscans: $10 (50 scans per month)

- Snail mails: $2 per credit

Zoho Books Features

While Zoho Books’ Free plan includes basic features, like invoicing and expense tracking, the advanced capabilities you will receive depend on your subscription plan. Below, we briefly discuss the results of our case study of Zoho Books Professional within the 11 categories, plus a link to videos where you can watch our complete assessment of each feature.

General

9.8 / 10

POINTS

Zoho Books offers almost all the general features and benefits you may desire from an accounting program, including the ability to set up your organization profiles, import and modify chart of accounts, enter opening balances for bank, credit card, and other types of accounts, and lock your books when you’re ready to close out the year. For an additional fee, you can set up additional users and give them only the access needed for their role. The program is generally easy to set up, but since it’s a very complicated program, there are some features that are hidden within each other, which makes it a bit difficult to navigate especially for new users. However, when you get used to the nuances, you should be able to understand the software easily.

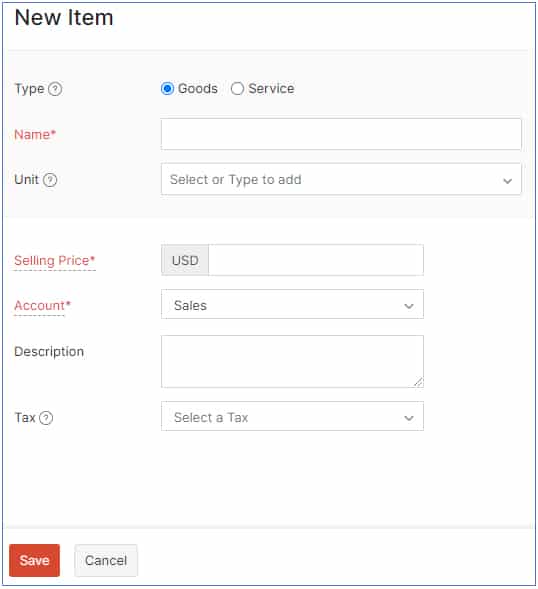

A/P

The benefit of adding product and service items is you can provide a description and price that will populate on all your purchasing and sales forms automatically. Also, a product item is required for any inventory item you wish to track.

Other important features in the A/P system include:

- Assign a payment as billable to a customer or project

- Send a copy of an expense receipt to your Zoho Books from the mobile app

- Short pay an invoice

Zoho Books Accounts Payable

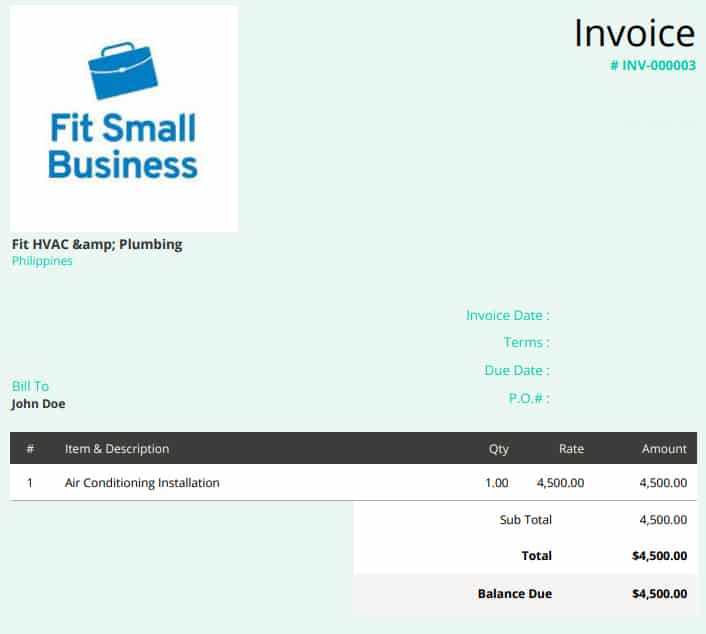

A/R

Zoho Books Accounts Receivable

Banking and Cash Management

Zoho Books has an advanced banking module for reconciling bank transactions. There are two ways you can import bank account transactions into Zoho Books—by connecting your bank account (live bank feeds) and importing bank statements manually. It doesn’t support QuickBooks Online files like QuickBooks Online and Wave, but you can upload files in other helpful formats like comma-separated values (CSV) files and Excel. You can enter a statement balance manually when reconciling your bank account, which is important since it enables you to perform a reconciliation even if you don’t import your bank activity. This is a surprising rarity among the software we’ve reviewed. After reconciling your bank transactions, you can see your detailed reconciliation status reports, including matched and unmatched transactions. You can save your reconciliation before completion and return to it later. The only issue we found is that there’s no option to enter monthly service fees as part of your reconciliation, so you’ll need to enter the fees in a separate transaction before reconciling.

Zoho Books Banking and Cash Management Video

Fixed Assets

As with most small business accounting software, Zoho Books has no features for managing and tracking fixed assets. You can record a journal entry and view the fixed asset entry, but that’s all that there’s to it. You can’t track fixed assets, and you can’t set up depreciation. Most small businesses leave the depreciation calculation to their tax preparers, but if you want to calculate depreciation on your fixed assets, we recommend Xero, the only bookkeeping software we’ve reviewed with this feature.

Zoho Books Fixed Assets Video

Project Accounting

Zoho Books allows you to create an estimate and associate a project to it using the Project module found on the Time Tracking menu. When creating an estimate, you can add items, like inventory, labor, and sales taxes. Once approved, you can convert the estimate into an invoice easily. You can also assign actual labor to a project and record the actual inventory used in the project. The only issue we encountered is that you can’t find the actual inventory used in a project in the actual vs budget report, though you can view it in the profit and loss (P&L) statement. If you need dedicated software for project management, explore our list of the best contractor accounting software programs.

Zoho Books Project Accounting Video

Sales & Income Tax

When the sales tax module is activated, Zoho Books calculates sales taxes automatically based on where you collect your taxes. You can create and manage records for independent contractors, apply tax on inventory items, and view sales tax liability details. Zoho Books can’t be used to pay and file sales and income tax returns. Zoho Books’ sales tax features are included in the assessment of the accounts receivable, so there is no separate video available.

Inventory

Zoho Books has complete inventory tracking features for tracking stock levels. It allows you to track the cost of goods available for sale and allocate that cost between ending inventory and the cost of goods sold (COGS). You can adjust the quantity and cost of inventory, and sort out items based on product details, vendor details, and stock keeping unit (SKU). If inventory accounting is important to you, then Zoho Books is a great choice. We have no separate video for Zoho Books’ inventory as it is discussed in the accounts payable and accounts receivable section.

Reporting

Zoho Books has an excellent selection of financial and accounting reports, including a general business overview, P&L statements, cash flow statements, balance sheets, general ledger, trial balance, A/P and A/R, sales and payment received, inventory, taxes, and project and timesheets. An important missing feature is that there’s no option to see the time and expenses you haven’t added to your invoice, which is something QuickBooks Online does. Nevertheless, Zoho Books still has powerful reporting capabilities.

Customer Service

Zoho Books offers only email support for Free users, but when you upgrade to any of the paid plans, you’ll get access to all forms of customer support, including phone support and live chat. You can either call a rep or submit a ticket and wait for them to call you. The live chat feature is available on the Zoho Books website and within the software itself. If these options are not enough, Zoho Books also offers a comprehensive selection of self-help resources available, including webinars, tutorial videos, a frequently asked questions (FAQs) page, and a user community forum.

Mobile App

Zoho Books boasts its unbeatable mobile application which contains all essential features that businesses need, at least when they are on the road. As reflected in the table below, Zoho Books has all the features we look for in good mobile accounting software.

| Send Invoices | ✔ |

| Receive Payments | ✔ |

| Enter Bills | ✔ |

| Capture Expense Receipts | ✔ |

| Assign Expenses to a Customer or Project | ✔ |

| Enter Bill Payments | ✔ |

| Categorize Expenses from Bank Feed | ✔ |

| Record Time Worked | ✔ |

| Assign Time Worked to a Customer or Project | ✔ |

| View Reports | ✔ |

Assisted Bookkeeping Options

Zoho Books offers assisted bookkeeping service through its Zoho Books Advisors program. Zoho Books advisors are Zoho Books-certified accountants, bookkeepers, and tax professionals who completely understand the program. If you need help from a Zoho Books Advisor, you can explore Zoho Books’ online directory of independent accountants, bookkeepers, and financial advisors, and find the best one that you think fits your needs.

Integrations

Zoho Books is well-integrated accounting software. In addition to its built-in integration with the other Zoho products, including Zoho Inventory, Zoho Checkout, and Zoho CRM, Zoho Books seamlessly integrates with third-party software, such as PayPal, Stripe, Gusto, Shopify, BigCommerce, and Mailchimp.

Bottom Line

Zoho Books is feature-packed accounting software that comes at a fraction of the cost of QuickBooks. It has a very competitive free plan, an easy-to-use interface, and ample features for automating business processes. Most especially, it has unbeatable customer service and a mobile application which is not even close to QuickBooks. Despite its invoice limitation particularly in the Free and Standard plans, you may find Zoho Books as good as, if not better than, QuickBooks.

Credit: www.fitsmallbusiness.com